Atlantic Canada pool builders tackle a record number of damaged pools due to winter and resulting insurance claims

Insurance claims galore

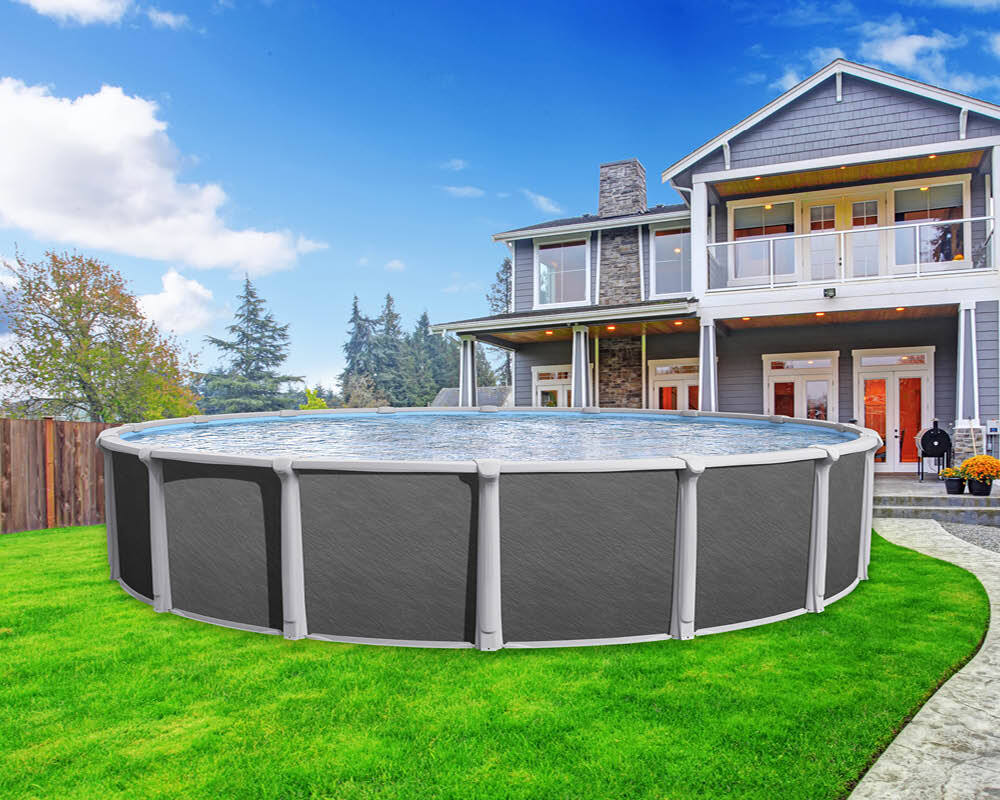

For pool owners, this type of weather does not bring many positive outcomes. A typical spring in this market (population of 120,000) would yield approximately eight to 12 insurance calls. This season, by May 20, this author had received 47 insurance claims ranging in severity from a simple liner replacement to a full pool replacement. Insurance claims ranged from buckled above-ground pool walls to damaged inground pool liners and steps. In some cases, inground pool walls even caved into the vessel.

Some homeowners started their insurance claims early after noticing some sort of damage, while others found their pools without any water in them at all.

The claim process

Insurance claims can vary from one company to the next; therefore, in a busy year such as this, pool company owners should have the insurance firm conform to what works for them. This season, this author told all of his customers who called for help to have their insurance company e-mail the particulars of the claim. For example, customer name, address, pool type (i.e. above-ground, inground, etc.), claim number, and insurance company.

Once the information was received, the work began. It started with scheduling site inspections and taking lots of photos and then preparing three documents.

First was a ‘cause of loss report,’ which explained what the cause of the damage was, where it was localized in the pool, along with photos to show the loss that occurred. Next, an estimate for repair or replacement was prepared. This document itemized all of the new components required to repair or replace the pool as well as the labour costs to remove the old pool and install the new one. Keep in mind, insurance is to make a customer ‘whole’ again, so things like water and chemicals were also included. The last document is an invoice for the work to prepare all of these items. This author, along with other pool companies, will notify the insurance company that the invoice charge for the inspection will be waived if they are awarded the job.

While some might think reinstalling a pool where one previously existed might be easier than installing a new pool, they are wrong. There are many variables to consider, for example:

- Was there a deck around the pool that could make it difficult when installing the new pool?

- Did water erode the existing pool base to the point that it needs to be removed and redone?

- If the pool style has changed, will the new one fit?

All of these questions have to be answered before the estimate is submitted to the insurance company. They are likely to cover all costs (except the deductible from their customers), but they do not like to payout additional money once the claim has been funded. If a pool company is careful in going over all of the details of the new pool install, insurance claim jobs can be profitable.

With insurance work, it is often assumed pool companies only repair and/or replace pools they installed. This is not the case, however. This season, this author handled 47 claims of which six were installed by his company. Therefore, this type of work can be a great opportunity to get new customers into the store and become new clients.

It is important to mention, any insurance company that has not had much experience with pool damage will have questions for the pool builder. In this author’s experience, these questions can sometimes be leading with regards to the pool damage. For example, an insurance company might ask: “Is this because the customer did not close the pool correctly?” While most insurance companies want to look after their customers, none want to payout the claim if it is found to be the homeowner’s fault. Therefore, forming the ‘cause of loss report’ to show the real culprit was the extreme winter weather, and not the homeowner, is not only the truth, but important for the claim to be approved. With the winter this region experienced, where in some cases snow drifts were higher than homes, all one could do is wait for spring and hope for the best.