Pool industry remains strong: report

by arslan_ahmed | April 20, 2023 4:41 pm

Editor’s note: This is a summary of our 14th annual industry survey and our 44th annual report on the state of the Canadian pool industry, including statistical information and market analysis. Information is based on Pool & Spa Marketing’s reader survey results, as well as Statistics Canada’s building permit records for swimming pools, with an overview of new pool permits for census metropolitan areas (CMAs). The figures are conservative and do not reflect many of the rural areas that do not require building permits for pool construction.  [1]

[1]

By Jason Cramp

Over the last few years, the pandemic significantly impacted the way people spend their leisure time, and for many, that has meant investing in their homes—in particular, backyards. For the pool industry, this meant a 44.8 per cent increase in permit registrations between 2019 and 2020, and an additional 22.5 per cent increase between 2020 and 2021. Over the course of these two years, 40,890 permits were registered, which was more than the number of registrations in the three years prior (2017 to 2019).

In 2021, many builders had substantial increases in gross sales and expected the same for the 2022 season. In fact, depending on where a builder was located, the demand for pools that year alone saw many builders with packed schedules for new construction heading into 2023. Some even expected to be sold out by July/August of the 2022 season.

The tipping point

There are two sides to every coin, however. Due to the pandemic, one of the biggest challenges faced by the industry has been the shortage of workers and supply chain disruptions which, in some cases, caused delays in the delivery of pool equipment and materials, making it difficult for companies to meet customer demand.

Further, many companies have experienced price increases for materials due to supply chain disruptions and a decrease in availability. These challenges have led to longer lead times for the completion of pool projects and increased costs for both the industry and consumers. Similar to many other markets, the pool industry needed to adapt to find new ways of mitigating the impact to maintain business continuity.

As many homeowners continued to stay home, and the desire to own a backyard pool remained strong, the impact on the industry (as described above) compounded by increasing interest rates, inflation, fluctuating consumer confidence, and concerns over household finances, only 12 per cent of respondents to The Conference Board of Canada’s June 2022 index of consumer confidence believed it was a good time to purchase large-ticket items.1

What did this mean for pool permit registrations? After a 293 per cent increase between January and March 2020 to 2021, 32.6 per cent fewer permits were issued during this period in 2022. This decrease continued into April, May, and June which was the height of the 2021 season. That said, it was not all doom and gloom as pool builders across the country still preserved through the pandemic-fuelled economic woes. Pool permit registrations in 2022 did not reach the decade-high numbers seen in 2021; however, they were the third most recorded in the last 12 years.

Current industry trends

Builders faced a challenging period of three consecutive seasons, with no break in between. They were confronted with an increased demand for pools, navigating supply chain difficulties, and dealing with labour shortages which triggered a chain reaction. Consequently, in 2020, numerous builders had already reserved their spots not only for 2021, but also the 2022 season.

In the past three years, builders have undertaken nearly the same number of projects as they did in the preceding five years, and there is still more work to be done. It is expected that the number of permit registrations will continue to exceed the 10-year average, and service work will become a significant aspect of one’s business. As a result, more than half of the participants in Pool & Spa Marketing’s industry survey anticipate being in a comparable or related position in the industry five years from now.

In the past three years, builders have undertaken nearly the same number of projects as they did in the preceding five years, and there is still more work to be done. It is expected that the number of permit registrations will continue to exceed the 10-year average, and service work will become a significant aspect of one’s business. As a result, more than half of the participants in Pool & Spa Marketing’s industry survey anticipate being in a comparable or related position in the industry five years from now.

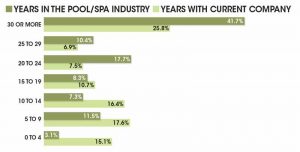

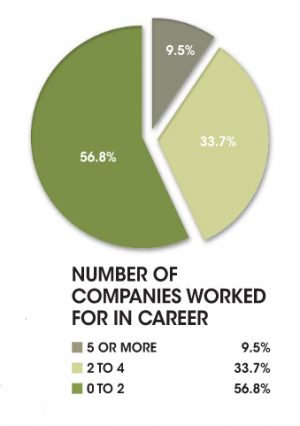

[2]Even though 15.6 per cent of individuals plan to exit the industry by 2027, there is a constant stream of young professionals under the age of 35 joining the aquatics industry. Despite the recent increase in work hours, job-related stress, and difficulty managing a decent work/life balance, nearly 70 per cent of survey respondents have been working in the pool business for more than 20 years, while more than 50 per cent have held this career for over 25 years. Although staffing in this seasonal industry can be challenging and has become particularly apparent in the past three seasons, 57 percent of respondents have been with their current company for more than 15 years and 56.8 percent have worked for only one or two businesses.

[2]Even though 15.6 per cent of individuals plan to exit the industry by 2027, there is a constant stream of young professionals under the age of 35 joining the aquatics industry. Despite the recent increase in work hours, job-related stress, and difficulty managing a decent work/life balance, nearly 70 per cent of survey respondents have been working in the pool business for more than 20 years, while more than 50 per cent have held this career for over 25 years. Although staffing in this seasonal industry can be challenging and has become particularly apparent in the past three seasons, 57 percent of respondents have been with their current company for more than 15 years and 56.8 percent have worked for only one or two businesses.

A year in review

In the 2022 report, an examination of the pool industry will be conducted, highlighting both its successes and failures. The report will also present the findings of Pool & Spa Marketing’s survey that will shed light on important details such as staff and company profiles, compensation, and economic factors that influenced the industry in the preceding year. The report will include a thorough analysis of permit registrations over the course of 2022 and will feature interviews with manufacturers, distributors, builders, and retailers to provide a comprehensive view of the pool industry on a national level, including a province-by-province breakdown. The report will identify several trends that will be helpful in anticipating what to expect in the 2023 season

and beyond.

A full copy of the report can be purchased by visiting www.poolspamarketing.com/industry-report.

Notes

1 See “Index of consumer confidence: June 2022,” published online by The Conference Board of Canada on June 29, 2022. For more information, visit https://www.conferenceboard.ca/product/index-of-consumer-confidence-june-2022[3] (Accessed on March 21, 2023).

This report and all the figures contained herein are copyright to Kenilworth Media Inc. No use may be made of this or any part of the data or reproduction of charts or graphs without the express written permission of Kenilworth Media Inc. © 2023

- [Image]: https://www.poolspamarketing.com/wp-content/uploads/2023/04/StylizedBG.jpg

- [Image]: https://www.poolspamarketing.com/wp-content/uploads/2023/04/Untitled-1.jpg

- https://www.conferenceboard.ca/product/index-of-consumer-confidence-june-2022: https://www.conferenceboard.ca/product/index-of-consumer-confidence-june-2022

Source URL: https://www.poolspamarketing.com/trade/features/pool-industry-remains-strong/