What is in store for the pool industry in 2021?

History repeating itself

Bestselling author James Rickards provides a fascinating look into the correlation between the growing financial burden and the affects of the coronavirus pandemic in his book The New Great Depression. Rickards compares the previous four major global pandemics within the last 100 years to what the world is currently experiencing.

One of the most notable arguments relates to lockdowns and the similarities to the pre-depression era of different countries throughout the years. A key component in triggering an economic depression—whether nationally or internationally—derives from a crushed economy. For instance, heading into the 1930s, Germany’s economy was absolutely decimated, not just from the First World War, but from reparations that followed with the Versailles Treaty. Even Winston Churchill argued against the severity of these demands by leaders of allied nations. During the same period, the U.S. saw rapid growth in the stock market through most of the 1920s. However, by 1929 the cycle shifted, and unemployment was on the rise, “leaving stocks in great excess of their real value.”

What followed on a global scale was the Great Depression, a Second World War, and a more than 30-year economic recuperation for stabilized positive economic growth. Fast forward to modern day and the same warnings can be seen. The financial issues uncovered in the latter half of 2019 were a warning sign that had a band-aid fix. The response to the pandemic in early 2020 (which continues today) perpetuates this growing economic disaster as lockdowns have resulted in many businesses closing temporarily or permanently, forcing unemployment to rise dramatically.

There are several factors that could have led to the rebounding market in 2020, after the worst decline in history. For example, most stock trades these days are done by artificial intelligence (AI), coded to seek out certain news headlines and market dips to buy and sell stocks. Second, the amount of newly printed money created and pushed into circulation grew exponentially from governments around the world to keep their respected countries functioning. To put this into perspective, both Canada and the U.S. saw sharp increases to the monetary supply starting around April 2020. Prior to this time, Canada had a monetary supply (M0) of about C$100,000 million, which jumped to just under C$440,000 million as of September 2020. In the same timeframe, the U.S. went from roughly US$16,000 billion prior to April, to just more than US$19,000 billion by September 2020. Further, to see just how much spending the Bank of Canada did in 2020, one can simply search for ‘Bank of Canada Balance Sheet’ and see the relation to other central banks. The result has essentially left stocks to be much higher than their real value once again.

The point this author is trying to make is for the reader not to be fooled by quick rallies in the markets as an overall perspective on economic growth. This does not mean there were not any actual positive economic factors that drove the markets up—various home renovation work was in high demand along with residential real estate prices that continued to soar for example, but how long can that last given increased lending restrictions and decreased household income?

Another factor to keep in mind is 2020 was an election year in the U.S., and it is next to impossible for a sitting U.S. president to be re-elected with a stifling economic decline, which gives major incentive to ensure the markets look appealing come election time. That said, this author—though not an economist—believes another market correction could be coming soon. Further, depending on how consumer habits are impacted moving forward, this could be the perfect breeding ground for higher inflation.

Where is the opportunity?

Taking a broader look, with the volatile economic landscape currently residing in the global markets, it is safe to say many people have not only lost their job, but could also lose a lot more money in the coming years and are worried about how they will survive moving forward. The good news is interest rates are at an all-time low, real estate will likely benefit regardless (prices are still soaring at the time of writing), and although there may be more people with less money to spend, there will still be many who have more than enough money to invest in their backyards.

Looking back to 2008, some companies shifted their focus from new construction to renovations and service work (which was deemed essential in most provinces throughout 2020) to meet the change in demand. Further, as the nation moves forward through this unprecedented time, the public’s mental health will begin to wane. This author wrote an article in the September 2020 issue of Pool & Spa Marketing shedding light on a second growing pandemic and how the pool and spa industry could help. With the Canadian Mental Health Association (CMHA) pleading for further support—even before the coronavirus pandemic hit Canada—the amount of people suffering from serious mental health issues as a result of the pandemic protocols has spiked through the roof.

It would be in the public’s best interest for governments on all levels to develop programs and incentives aimed at providing more people access to the benefits the pool and spa industry has to offer in the name of mental health—especially in the years to follow this pandemic. There are many scientific studies to back this up.

Other areas of opportunity may derive from thinking outside the box to provide certainty within lockdown scenarios. For example, the industry saw chemical suppliers and other companies branch into producing hand sanitizer, giving more certainty of being deemed ‘essential.’ Further, positive research on how copper negatively effects the coronavirus could result in more products incorporating the use of this metal moving forward. Of course, the term ‘staycation’ will continue to sound more appealing than ever before as the travel industry has been decimated.

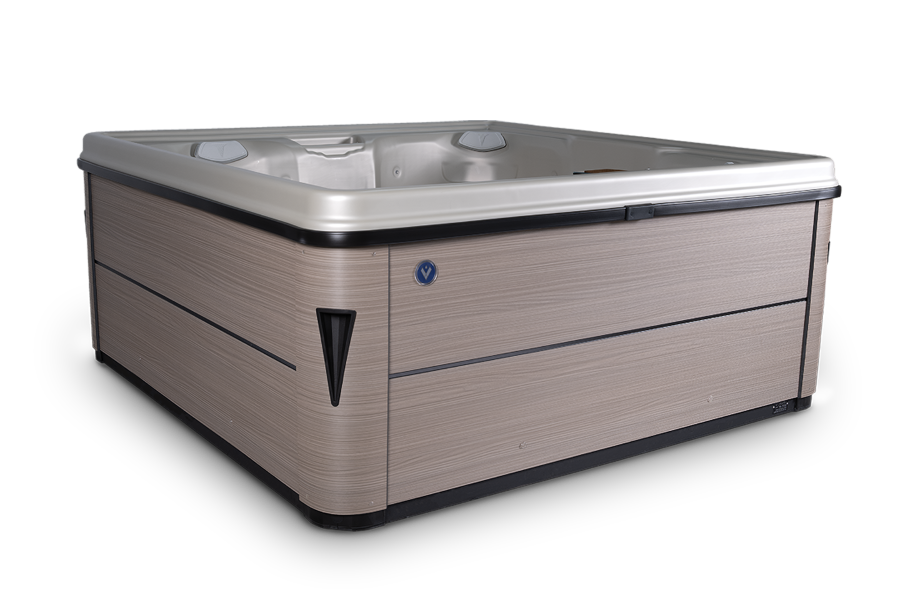

Even when some normalcy returns, many families are going to look for ways to justify staying home. Investing in a backyard oasis will provide families a place to continue creating fun memories together regardless of global circumstances.

With lockdowns and even curfews put into effect, there are still opportunities for companies to expand. Most customers and prospects are at home, and sales teams need to adapt and adjust. People are spending more time on social media platforms than ever before, which means it is easy to connect with new prospects. However, though a large portion of pool and spa companies recognize the importance of social media, some do not know how to use these powerful tools.

The first thing a pool and spa company needs to do is to educate their sales team on how to use these platforms. This begins by having an understanding on which platforms are available to use. The number of platforms, tools, and methods can vary and change quite a bit; however, the end goal remains the same. Whether it is through the use of pictures, video, articles, podcasts, etc., the ability to build a brand and stay top of mind is very achievable. Having a face behind the name allows others to connect with the person (or people) who make up a company. There are many social media consultants capable of coaching teams on how to build a brand and reach more prospects through these free tools. At the most basic level, one can simply use social media to find the influencers on each platform who have a large following.

Another growing area with social media platforms is known as ‘entertain-merce’ where people and companies create live action programs, through various forms of media, as a way to entertain their audience, as well as sell product. Many different social media companies have adapted a ‘live action’ feature to their platforms and it is as simple as pressing a button to go live. Even this author developed a Saturday morning Facebook Live program during the lockdown in early 2020 to offer the pool and spa industry on provincial and national updates. Regardless of the platform, the point is to stay top of mind and relevant.