Industry salary survey reveals latest trends

Compiled by Jason Cramp

This report marks the seventh year we’ve asked readers of Pool & Spa Marketing to participate in our annual salary survey to provide input on the state of the country’s pool, spa/hot tub, and landscaping design/build and retail industry, as well as offer foresight into the coming season and years ahead.

The following are the collected results, based on the responses we received to the survey’s multiple-choice format.

Basic demographics

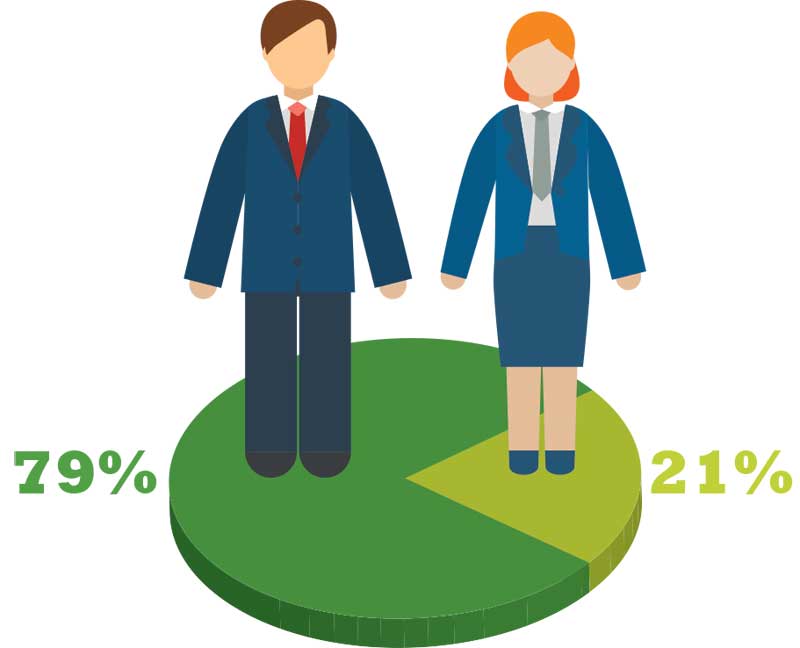

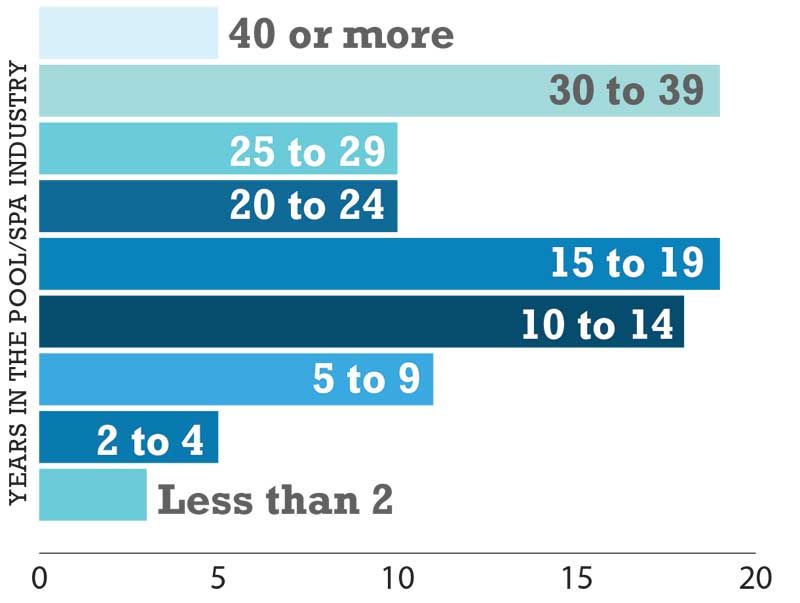

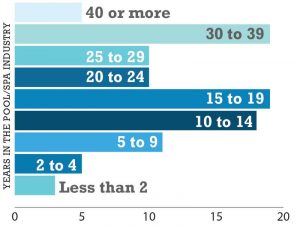

We asked and the industry responded. Industry professionals across all Canadian regions provided feedback. As the survey has shown in the past, men once again made up more than three-quarters of all responses. Women were represented by just more than 20 per cent, which was slightly lower than in 2016. Almost 80 per cent were older than 40, with 47.5 per cent of all respondents having more than 25 years of industry experience; 52.5 per cent said they have been in the industry between 10 and 24 years. This is an increase of more than 10 per cent in this demographic.

Moving on or staying put?

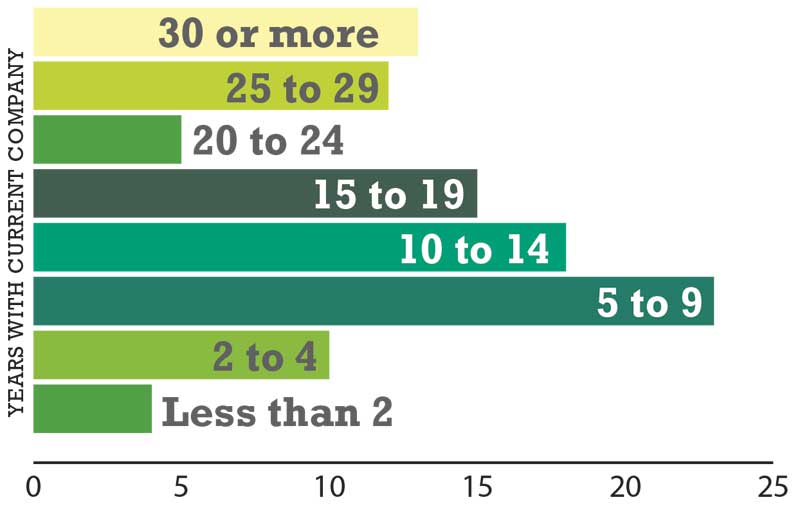

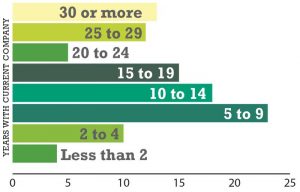

In keeping with the trend the last survey showed, with respect to passing on the business (in many cases to younger family members), the results of the current survey are on point. The only difference is the current survey suggests many industry veterans are, in fact, retiring. Those respondents with more than 40 years in the industry were the second largest demographic in 2015, whereas now they are one of the smallest. In terms of experience, those who have been in the industry between 10 and 15 years represented 36 per cent of all respondents. Longevity is another possible indicator of a change of guard, as 51 per cent of respondents have been with their current company between two to 14 years, an increase of 10 per cent year-over-year. Almost 60 per cent of all respondents have worked with less than two companies, while 32 per cent have been with two to four companies.

Who are you?

Pool & Spa Marketing is dedicated to providing leaders in the pool, spa/hot tub and landscape industry with the latest news, products, services and techniques. The magazine has a huge following—from builders/contractors and service professionals to landscape architects/designers and retail sales managers. In fact, the largest number of respondents selected ‘business owner’ as their job description, followed by ‘other.’ Additional popular occupations included retail sales manager, builder/contractor (residential), landscape/architect designer, and service manager.

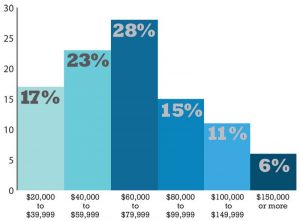

Salaries

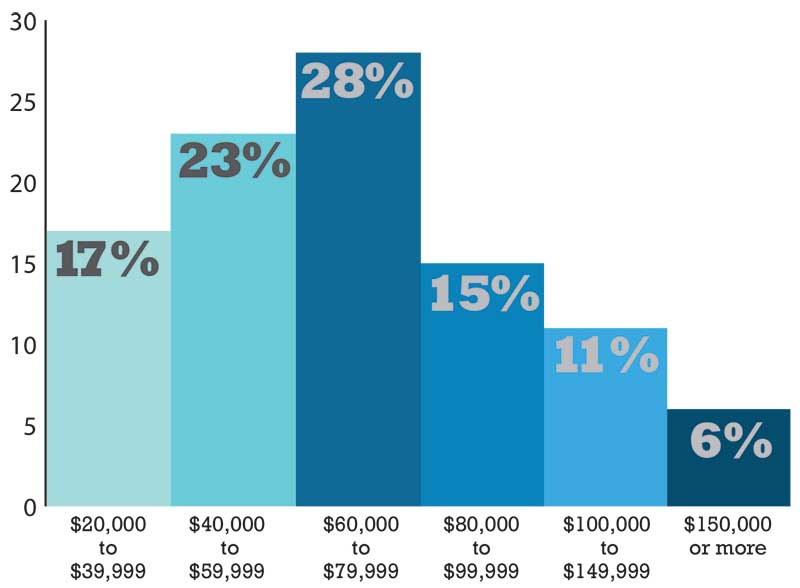

Respondents to this year’s salary survey represented a sweeping view of the different employment sectors within the pool and spa/hot tub industry. From business owners, supervisors, and sales managers to pool operators, service technicians, distribution managers, and landscape architects, the field was diverse. Considering the average Canadian annual salary in 2016 was just under $50 K per year, those employed in the aquatics industry are doing well, as 43 per cent of respondents said they earned between $60 and $99 K, while more than

16 per cent made more than 100 K. Similar to last year’s survey, 52 per cent of respondents did not receive a raise, while 35 per cent got a cost-of-living raise (between one and five per cent).

Education

Roughly one sixth of all respondents (30 per cent) have some college education, but no degree, while almost the same number of respondents (28 per cent) have an undergraduate degree. Although the number of respondents who said they have a degree increased by four per cent year-over-year, 92 per cent (six per cent more than the previous survey) said it was not related to the pool and/or spa/hot tub industry. For those employed in this trade, their education comes from within the industry with more than half of respondents (56 per cent) saying they have participated in specific manufacturer/dealer training courses. Thirty-four per cent said they have taken the Certified Pool Operator course and 20.5 per cent have participated in courses through the Pool & Hot Tub Council of Canada (PHTCC).

Working hours

Due to the nature of this seasonal business, the unpredictability of the weather, and the fact every homeowner wants their project installed ‘yesterday,’ working long hours in the pool and spa/hot tub industry is the norm. That said, even with last summer’s favourable weather and more than 13,000 permits registered, 36 per cent of respondents said they worked more than 41 hours per week, which is nine per cent less than last year. Another 36 per cent were on the job for more than 51 hours, representing a four per cent decrease year-over-year.