The Ins and Outs of Job Costing

Tackling take-offs

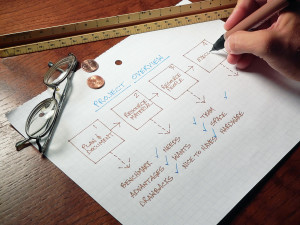

Establishing this type of methodology begins with a good ‘take-off,’ a thorough cost analysis, breaking down a project item by item.

Back when I was first working in construction, I had a partner who came from a general contracting background. For a long time, he made his living by estimating huge construction projects and taking off the details of the job, right down to the number of screws and hinges on the doors. When we started working together, he taught me to do that very thing on every single job. Then, when the job was finished, we would go back and run the numbers again so we could learn exactly what we were spending to get the job done.

This exercise emphasizes the difference between each job, even among those that, when they begin, might seem similar to past projects. Through the before-and-after take-off, one can see exactly where things changed. This helps teach pool and spa professionals to anticipate and accommodate those variables in the future, to avoid shortchanging themselves.

The key to this process is thoroughness. All materials must be counted—steel, concrete, plumbing and fixtures, valves, tiles, skimmers, equipment and all the little parts and pieces that go into the project. Then, additional costs must be added, including those for plans, permits, trenching, backfilling, supplying soil, hauling trash, pre-filtering fill water, startups and customer instruction. Basically, everything that costs money, even the smallest amount of time or materials, must be factored into the equation.

Contractors must also calculate other factors that are not easily defined, such as warranty work. In order to be a top-flight firm, a company must have freedom in its pricing structure to be able to do absolutely everything necessary to make the client happy. To that end, builders can incorporate an anticipated, relatively small dollar amount for warranty work as a line item. This can be included on every job (and marked up, which will be discussed below). This way, when the client eventually needs or wants something, the money is already in to cover the extra expense (with even more money to be made on the new work).

Of course, these costs do not come up on every job; however, in some cases the amount of warranty or extra work can run high. In time, it all balances out. Plus, it can help put the pool and spa professional’s mind at ease. Instead of dreading calls and worrying about what client requests will do to the bottom line, builders can meet clients’ needs comfortably and enthusiastically. In some cases, a ‘miscellaneous’ line item can be included (and marked up) to add further to the builder’s comfort level.

The bottom line is to include and mark-up every single thing that contributes to the design-and-build process, from the point the clients sign on to the day the project is completed. These things add up to a number commonly referred to as the cost of goods sold (COGS). Only once a builder has fully and accurately estimated a project’s cost can he or she confidently add a mark-up to the project. This mark-up is a key calculation.

Estimating overhead

Every business owner should periodically take the time to estimate overhead costs—in other words, all non-job-related costs that go into keeping the doors open, the lights on and the wheels turning.

This includes a range of items such as office space, utilities, supplies, office furniture and equipment, support-staff salaries, travel, training and education costs, insurance, taxes, depreciation, association dues and entertainment. Overhead also includes salaried employees involved in general, non-job-specific positions necessary to keep a business running, such as office administration, general management, etc.

These expenses should be tallied and related to each job as a percentage. If, for example, a business does $1 million in annual volume and it costs $120,000 to keep the business operational, overhead can be calculated at 12 per cent. As such, every job taken should clear that percentage in order to create profit margin.

Overhead can vary substantially, of course, depending on the size of an operation, its marketplace position, advertising and salaries. It also fluctuates greatly with volume, which is why it should be periodically recalculated to correspond to changes in direct costs.